Amur Capital Management Corporation Fundamentals Explained

Amur Capital Management Corporation Fundamentals Explained

Blog Article

Unknown Facts About Amur Capital Management Corporation

Table of ContentsWhat Does Amur Capital Management Corporation Do?Not known Details About Amur Capital Management Corporation Amur Capital Management Corporation Fundamentals ExplainedTop Guidelines Of Amur Capital Management CorporationOur Amur Capital Management Corporation StatementsThe Facts About Amur Capital Management Corporation Uncovered

Foreign direct investment (FDI) takes place when a private or company owns at the very least 10% of a foreign business. When investors possess much less than 10%, the International Monetary Fund (IMF) defines it merely as part of a stock profile. Whereas a 10% ownership in a firm does not give a specific capitalist a controlling interest in a foreign firm, it does enable influence over the company's monitoring, procedures, and overall plans.Companies in creating countries require multinational financing and proficiency to increase, give framework, and direct their global sales. These foreign firms need exclusive financial investments in infrastructure, power, and water in order to boost jobs and wages (mortgage investment corporation). There are numerous levels of FDI which range based upon the kind of business involved and the reasons for the financial investments

What Does Amur Capital Management Corporation Do?

Various other types of FDI consist of the procurement of shares in an associated business, the incorporation of a wholly-owned firm, and engagement in an equity joint venture across international limits (https://amurcapitalmc.weebly.com/). Capitalists who are preparing to involve in any kind of FDI might be important to weigh the financial investment's benefits and drawbacks

FDI boosts the manufacturing and services field which causes the production of work and aids to reduce unemployment prices in the nation. Increased employment translates to greater revenues and equips the population with more purchasing power, improving the total economy of a nation. Human capital involved the expertise and competence of a labor force.

The production of 100% export oriented devices aid to assist FDI investors in boosting exports from other nations. The flow of FDI right into a nation converts right into a continuous flow of forex, assisting a country's Reserve bank keep a flourishing book of forex which leads to stable exchange prices.

Amur Capital Management Corporation Can Be Fun For Anyone

As a result of FDI, countries' neighborhood business start wearying to spend in their domestic items. Other nations' political movements can be altered continuously which can hamper the financiers. Foreign straight financial investments can sometimes influence exchange rates to the benefit of one nation and the detriment of an additional (https://amurcapitalmc.start.page). When investors spend in foreign regions, they might see that it is much more pricey than when goods are exported.

Taking into consideration that foreign direct financial investments may be capital-intensive from the perspective of the investor, it can occasionally be very risky or financially non-viable. Continuous political changes can lead to expropriation. In this situation, those nations' federal governments will have control over investors' property and possessions. Lots of third-world nations, or at the very least those with history of colonialism, fret that international straight financial investment would lead to some sort of modern economic colonialism, which subjects host nations and leave them at risk to foreign business' exploitation.

Preventing the success void, enhancing health and wellness outcomes, boosting earnings and giving a high price of financial returnthis one-page record summarizes the advantages of purchasing high quality very early youth education for deprived youngsters. This file is commonly shown policymakers, advocates and the media to make the instance for very early youth education.

Some Known Factual Statements About Amur Capital Management Corporation

Consider exactly how gold will certainly fit your economic goals and long-lasting financial investment strategy prior to you spend - accredited investor. Getty Images Gold is usually thought about a strong possession for and as a in times of unpredictability. The rare-earth element can be appealing through periods of economic unpredictability and economic downturn, in addition to when rising cost of living runs high

Examine This Report about Amur Capital Management Corporation

"The perfect time to build and allocate a version profile would certainly be in less unpredictable and demanding times when feelings aren't regulating decision-making," states Gary Watts, vice president and financial expert site web at Riches Enhancement Team. Nevertheless, "Sailors outfit and stipulation their boats before the tornado."One way to figure out if gold is appropriate for you is by researching its benefits and disadvantages as an investment selection.

If you have money, you're effectively losing cash. Gold, on the various other hand, may. Not everyone agrees and gold might not constantly rise when inflation goes up, however it could still be an investment factor.: Acquiring gold can possibly aid capitalists survive unclear financial problems, considering the during these durations.

All about Amur Capital Management Corporation

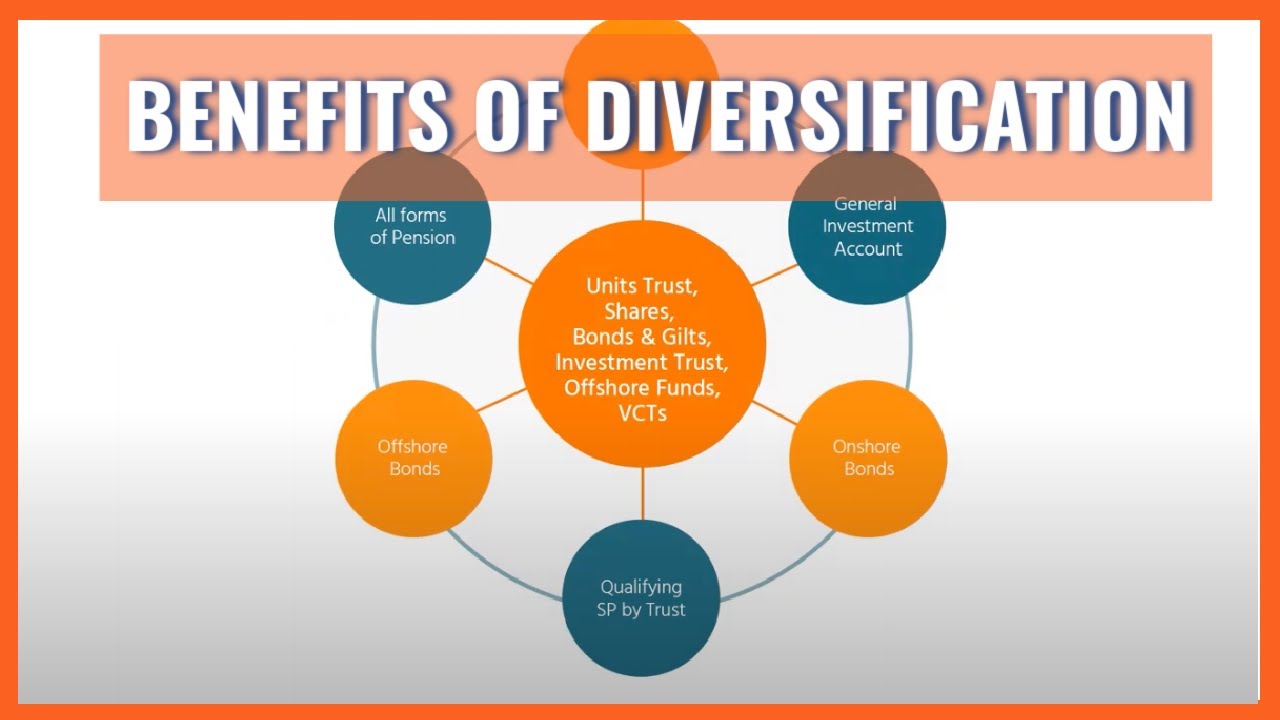

That does not suggest gold will certainly constantly increase when the economic situation looks unsteady, however maybe great for those that prepare ahead.: Some financiers as a method to. As opposed to having all of your cash locked up in one property course, different might possibly help you better manage threat and return.

If these are a few of the benefits you're seeking then start buying gold today. While gold can help include balance and protection for some financiers, like a lot of financial investments, there are likewise risks to see out for. Gold may outmatch other properties during specific periods, while not standing up also to lasting cost admiration.

Report this page